Professional advisors

Help your clients achieve smarter philanthropy.

You know your clients. We know philanthropy. Together we can create a giving plan that will best suit your client's needs and their dreams for the future.

Read our article in Chartered Accountants Australia-New Zealand's Acuity Magazine (April 2025) - 'Everyone can benefit from philanthropy' - read the article here.

How to leave a lasting legacy.

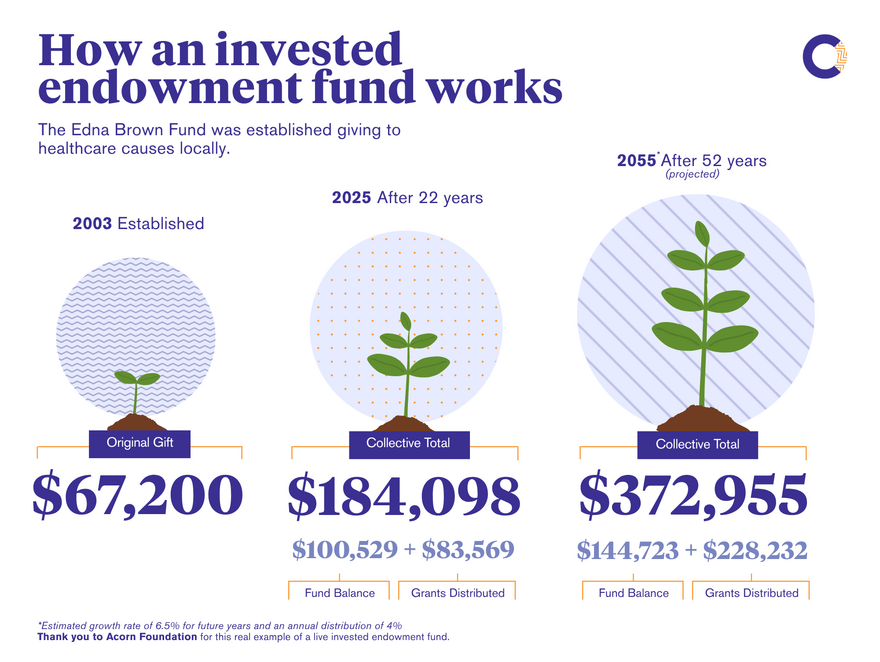

If your client is interested in exploring more structured philanthropy the local Community Foundation can help to make it a lasting legacy for their community. With our smarter giving model, gifts can be continuously invested to grow into ongoing funding sources.

Use our fund calculator here to explore how donations can give and grow over time.

Why have the ‘philanthropy’ conversation?

Many Kiwis want to give, or at least have the desire to make a difference. Conversations about how clients can have an impact and do good with their money are often warm and very rewarding ones. Philanthropy conversations are an opportunity for you to connect with your clients’ core aspirations and values and to really build a long term relationship with them.

Community Foundations can help to add significant value to your client relationships by offering professional philanthropic expertise to complement your existing skill sets and help you provide a more holistic financial planning approach.

"I'm a really proud advocate for Community Foundations. They can be a really effective and efficient way to execute a client's philanthropic strategy because they have all the audit, governance and management structures already in place. And, as not-for-profits, they maximise returns to community."

How we can help you.

We work in partnership with you, either in the background, supporting you to have the conversation with your clients about developing a philanthropic plan; or we can offer advice directly. However you prefer, we will always respect and work within the relationships you have established. Your role will be to provide counsel on legacy giving and maintaining the overall wealth planning relationship.

As your philanthropy services partner we can:

- Tailor a giving plan

- Provide information on giving strategies

- Take care of the administration

- Connect your clients with local causes, programmes or charities

- Accommodate gifts such as real estate, life insurance policies or shares, which are not easily transferable to other charitable entities

- Manage investments and distribute income

- Help you work through possible granting processes

- Help you deal with complex philanthropic objectives

- Offer guidance on including philanthropy in wealth planning conversations

- Offer inside local knowledge on organisations doing impactful work in the community

See our top tips for having philanthropy conversations with your clients

Want information on helping your clients achieve smarter philanthropy?

Download our free guide for more information on helping your clients achieve smarter philanthropy“I really enjoy talking to my clients about giving. I find most often it’s a warm conversation motivated by their desire to impact the community and their passion for a cause. Many people are also seeking reassurance that their wealth will be used wisely”