A simple legal conversation can change the world

Eleanor Cater

Membership Services Director

Community Foundations of NZ

17 September 2023

This article appears this month's in Lawtalk, The NZ Law Society magazine - read it online here

Research from across the world points to a pivotal moment where lawyers and estate planners have influence over estate planning conversations; a moment which is becoming hard to ignore.

With the intergenerational wealth of the baby boomers about to change hands, Legacy Research UK’s Dr Claire Routley1 says that we are at a pivotal moment in the world.

“This moment in time really is very important as we have a wealth transfer, the likes of which the world has never seen before. It has the potential to be transformational for society, but only if we manage it well”.

“Will making is not one of those things that people think about on a day-to-day basis, people tend to have a defensive barrier and their initial reaction is to push the conversation away. When people are talking with lawyers or advisors around their estate, this is the one time we can guarantee they will engage; so, it’s a crucial point to raise the possibility, and to educate people about their options for giving”, says Dr Claire Routley.

Picking the moment

The topic of philanthropy (or even simple charity giving), and the moment to raise it is during the estate planning process.

The theories of social psychology2 show how “our first defence when confronted with conversations around death is to push those thoughts away. Our second layer of defence is to create a sense of symbolic immortality.” It’s at that very moment that a person is ready to consider how they want to be remembered and the legacy they want to create.

“This has real implications for lawyers and financial estate planners, as to why their conversations are key moments for creating space to think about legacy giving”, says Dr. Routley.

In the United Kingdom, legal conversations about philanthropy are becoming more common. One in four professionally written wills now including a charitable gift, and 73% of lawyers and will-writers say that they raise the option with their clients.3

While we have no comparable research in New Zealand, work done by Community Foundations of Aotearoa New Zealand across the country suggests that we have a long way to go before we reach this threshold.

The groundbreaking UK Legacy Research and Behavioural Insights study in 20164 also highlighted this crucial moment in the will-making process.

“The Behavioural Insights Study showed that, when lawyers simply mention the idea of charitable giving, twice as many people will leave a gift to charity in their will. When the conversation is framed around social norms, three times as many people will give. This has enormous implications for practice, and it really is something incredibly simple”, says Dr. Routley.

“Lawyers and estate advisors should not be assuming people even know about, let alone have considered their options.”

While the wills and probate process is believed to be quick and effortless, there are choices which can often make this process appear complicated to the public. Different types of will gifts and a simple legal conversation can change this perspective completely. Estate planning lawyers and online free will-making websites offer step by step processes, but leaving a gift in a will usually reflects the bequest givers’ life experiences and history of giving throughout their life.

Five ways to hold a golden conversation

The golden conversation, which the behavioural insights research has shown can triple gifts to charity, is as easy as:

“Many of our clients like to leave money to a charity in their will; are there causes you are passionate about?”

Other useful and simple prompts include:

- “How would you like to be remembered?”

- “What changes would you like to see in the world?”

- “Have you been involved in any volunteering for a cause you care about?”

- “Did you know that there is more than one way you can give through a gift in your will?”

- “Did you know you can set up your own fund to give back to a cause for the long term (and it doesn’t need to be a separate trust)?”

Three methods of giving

Dr Routley says that clients can often be very empowered to find that there are further options to give, beyond traditional charity giving. This is particularly relevant to those with some wealth, with no direct descendants, and for those who are very passionate about community or a particular cause.

Options include:

- direct charitable giving

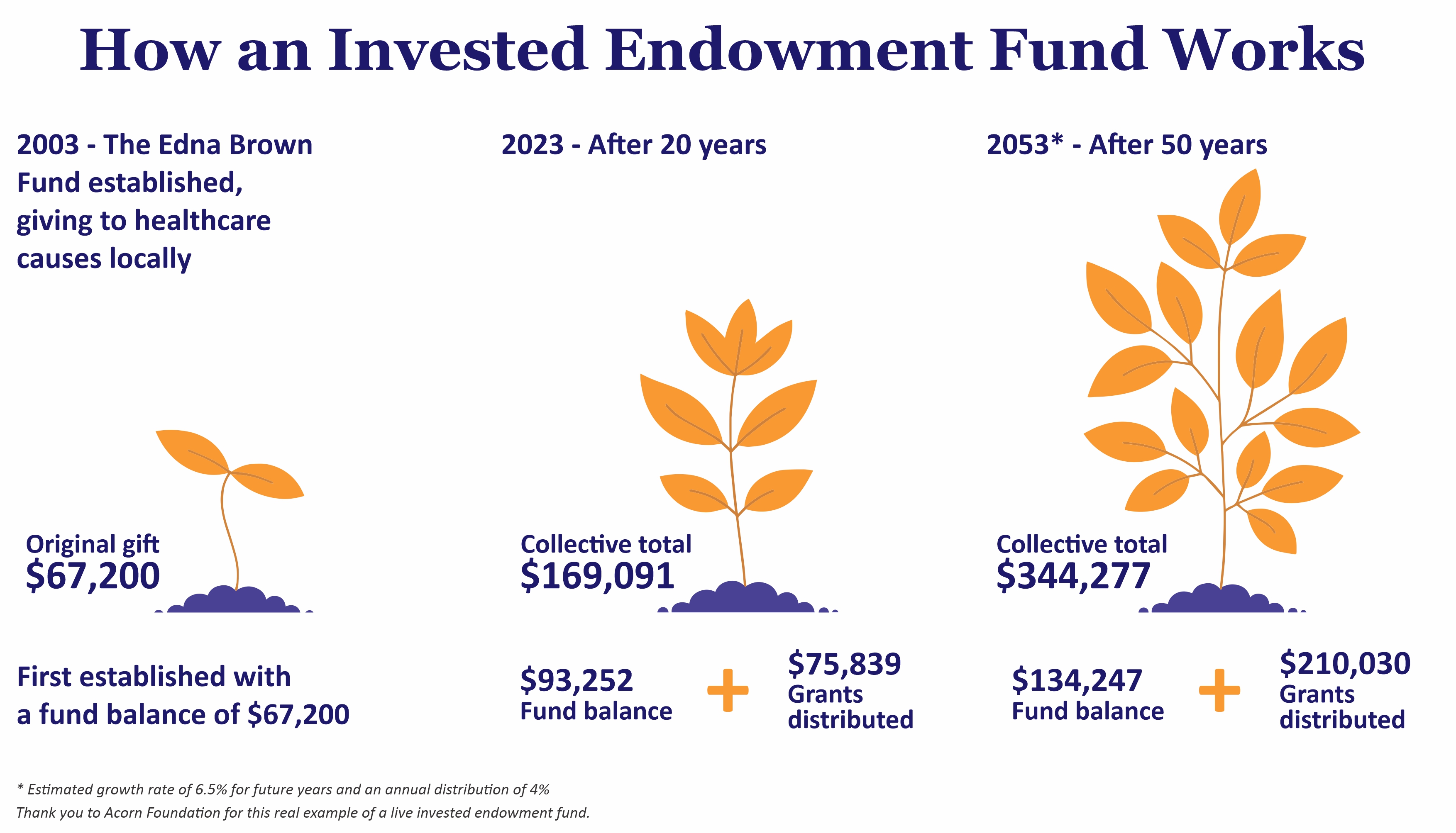

- an invested endowment fund and

- own charitable trust.

“I think that charitable giving is appropriate for many; however, the idea of invested endowment funds like the ones run by community foundations5 can be an empowering consideration for some. Most people aren’t aware that they can be actively involved in philanthropy, and this is a realisation for many.

It’s empowering for clients to know that there are non-profit options out there to set something up in perpetuity, without the need to set up your own trust”, says Dr. Routley.

A live topic in the legal profession

Across the world, conversations by legal professionals using philanthropic cues is a live topic. Organisations such as Remember a Charity in the UK, Include A Charity in Australia and Will Power in Canada actively work with lawyers to improve estate conversations around charitable giving. Their work is seeing real shifts, with gifts in wills rising significantly, largely because of lawyers and estate advisors understanding their crucial role in having these conversations.

“Lawyers need to know their influence; this is perhaps the biggest CSR (corporate social responsibility) moment that has presented itself to the legal profession in modern times, and it all comes down to one golden conversation at the right moment”, says Dr Claire Routley.

In the United Kingdom, recent research shows that charitable legacy giving has risen by 43 per cent over 10 years, with 20 per cent of charity supporters aged 40 plus now saying they have left a charitable gift in their Wills.6 In New Zealand, a 2022 study7 found that only 6 per cent of Kiwis have left a gift in their will to charity. This is a stark contrast to the United Kingdom when you consider what the potential intergenerational wealth transfer could mean for the future of Aotearoa New Zealand.

Finally, research shows that giving can be good for you!

Further research shows that giving can contribute to a person’s physical and mental wellbeing. This finding is useful in setting the scene for positive client interactions and enabling the emotional experience referred to as the ‘warm glow’ of giving.

“There is a real connection between gifts in wills and wellbeing – research8 shows that to be the case, there are lots of psychological processes related to legacy giving that are really very good for people, whether they are looking back over their lives or looking forward and thinking about the next generation. It creates a real sense of meaning and that’s where the psychological benefits lie”, says Dr Routley.

I’m keen to see some research undertaken to study whether philanthropy conversations are also good for lawyers; my hunch from the lawyers we work with across New Zealand suggests that helping clients create their legacy can be one of the most rewarding parts of a lawyer’s role.

It seems that one incredibly simple golden conversation is a win/win/win - for clients and for lawyers and for society.

[1] Handbook of Theories of Social Psychology (2012) Ch 19. Available at: https://psikologi.unmuha.ac.id/wp-content/uploads/2020/02/SAGE-Social-Psychology-Program-Paul-A.-M.-Van-Lange-Arie-W.-Kruglanski-E-Tory-Higgins-Handbook-of-Theories-of-Social-Psychology_-Volume-One-SAGE-Publications-Ltd-2011.pdf#page=419

[2] https://www.rememberacharity.o...

[3] https://www.bi.team/publications/legacy-giving-and-behavioural-insights/

[4] Read our earlier article on Community Foundations at https://www.lawsociety.org.nz/news/publications/lawtalk/lawtalk-issue-951/september-is-conversations-about-philanthropy-helping-your-clients-understand-their-options/

[5] https://www.rememberacharity.org.uk/about-us/latest-news/legacy-giving-up-43-in-the-past-decade/

[6] NZ’s Willpower: benchmarking study 2022, FINZ and Perpetual Guardian

[7] https://www.fidelitycharitable.org/content/dam/fc-public/docs/insights/on-the-leading-edge-report.pdf

[8] Routley, Sargeant and Lowthian (2022) What we know about legacy giving, Institute for Sustainable Philanthropy, UK.

Date Posted: 17 Sept 2023

Recent Posts

It’s easy to give and get (your tax) back

16 Jan 2026

All around the world, tax rebates are used to encourage people to donate more to charities and causes. They are a powerful way to inspire generosity and shows that private donations are truly valued in helping to build strong, vibrant communities.

Read moreThe overhead myth: are we strangling the charities we love?

29 Jan 2026

Community foundations work with hundreds of Kiwis who want to create positive change in their communities. We love the passion with which local people care about the work of community-led change, and in many cases the long-term commitment to enabling that change. However, there is a statement that we hear all too often: "I'm happy to pay for the work of the charity, but not the salary and overhead costs" ....

Read moreGiving Tuesday – beyond the spend fest

25 Nov 2025

Giving Tuesday is today, December 2nd, and over the years it has become a global movement, expanding to over 80 countries. While New Zealand is a long way from the USA we also find ourselves with many of the pressures to spend, spend, spend in the lead up to the festive season...

Read more